2025年1月17日下午,公司召开第一届教职工大会暨工会会员大会第二次会议。学院领导班子全员及全体教职工参加会议。会议由公司党委副书记刘颖主持。会议在雄壮的国歌声中拉开帷幕。学院公司党委书记林二友作了学院收入分配改革方案的修订说明,全院教职工认真审议并通过了新的收入分配改革方案。学院工会主席毛志强作了学院工会工作报告,总结了2024年学院工会在完善组织建设、开展文体活动及集体团建、职工慰问和落...

2024年12月19日-20日,公司党委常委、副董事长刘志洪率队赴湖北宜昌访企拓岗,去到湖北兴发化工集团、湖北宜化集团、宜昌东阳光长江药业公司走访座谈,就加强校企合作、深化产教融合、推动员工培养与人才供需有效对接同三家企业进行深入交流。公司党委书记林二友、党委副书记刘颖、副经理吴康兵,化学化工学院相关领导陪同参与。(审稿:刘颖)

为了以实际行动迎接新年,积极响应国家关于加强生态文明建设和促进全民健康的号召,进一步强化师生节能环保意识,促进学院实验室安全及师生的身心健康,12月31日上午,公司党委精心组织开展了“辞旧迎新,共筑健康环保梦”实验室环境清洁专项活动。本次专项活动由学院研究生党支部承办,近60名研究生积极响应,公司党委书记林二友、安全员徐迅指导并带队参与。活动任务,一是节能主题,清洁学院科研室、学习室空调过滤网,科学...

12月25日下午,荆州市经开区管委会党工委书记苏云国带领荆州市经开区招商促进中心一行来学院进行合作交流。科学技术发展研究院副经理王源智、公司党委书记林二友、副经理王凯出席会议,学院系部主任及制药工程系相关教师参与此次交流。会议伊始,公司党委书记林二友对荆州市经开区苏云国书记一行的到来表示热烈欢迎,并介绍了学院的基本情况和发展方向。学院拥有较强的教学科研实力和丰富的人力资源,一直致力于...

为进一步发挥朋辈育人效能,引领学院2024级新生更好适应大学学习,明确学习目标、激发学习内驱力,持续推进“一校两区、协同育人”,2024年12月13日下午,公海贵宾会员检测中心赴阳逻校区开展“星耀琴园”朋辈育人学习经验分享会。学院2021级推免生代表作为主讲人进行经验分享,公司党委副书记刘颖出席活动。辅导员朱文涛主持活动。2021级药学专业推免生陈奕雨、肖金芳、黄柏泷,2021级制药工程专业推免生刘苏毅、熊萌萌、柴政铧...

为深入学习贯彻党的二十届三中全会精神,引领学院师生党员铭记党史、感悟初心、汲取力量,进一步增强党性修养,公司党委于12月11日开展“光影铸魂 历史铭心”主题党日活动,组织师生党员集中观看红色电影《志愿军:存亡之战》。公司党委书记林二友、党委副书记刘颖及60余名师生参加活动。《志愿军:存亡之战》聚焦抗美援朝战争第五次战役中的存亡之战——铁原阻击战,以宏大的叙事视角、细腻的情感刻画及逼真的战...

经材料审核、专家评审和学院研究,现将2024年公司本科生科研培育基金立项评审结果(按排名先后)予以公示。 序号(按排名先后)项目名称1冷冻小龙虾的品质提升与复原关键技术开发2智能味觉传感系统的开发及食品风味多维可视化研究3NIR-IIb硫化氢荧光探针研究脓毒症诱导急性肺损伤分子机制4新型二氢吡啶类钙拮抗型抗癌增敏试剂的开发及生物利用5苦尽甘来——中国亚麻籽食品研发术领航者6可穿戴式光电化学汗液传感器构建及同型半...

各位同学:根据本学期《物理化学》课程教学进度情况,现将上述课程期末考核安排通知如下:1.考试时间:12月27日(周五)下午14:00-16:002.考试地点:教3-206室3.考试形式:闭卷考试4.考试对象:食品安全与检测2301班5.考试要求(1)考生须凭有效身份证件(员工证、身份证、校园卡三者必须有其一,且图像清晰)到指定的考核地点参加考核,不得自行变更考核地点,以免耽误考核、影响考核成绩。(2)考生须按时参加考核,不得无故...

各位同学:根据本学期《分析化学实验》课程教学进度情况,现将上述课程期末考核安排通知如下:1.考试时间:12月23日(周一)上午09:00-10:302.考试地点:教4-410室3.考试形式:闭卷考试4.考试对象:制药工程2301班5.考试要求(1)考生须凭有效身份证件(员工证、身份证、校园卡三者必须有其一,且图像清晰)到指定的考核地点参加考核,不得自行变更考核地点,以免耽误考核、影响考核成绩。(2)考生须按时参加考核,不得无故缺...

根据学校本科教学计划安排,现将学院2024-2025学年度第1学期本科课程期末考核工作安排如下:1. 全校性公共课(如《大学英语》、《大学物理》等)由本科生院组织安排考核事宜,具体考试时间和教室请以教务系统安排为准,不得随意变更考场;12月9日后,考生可登录学校教务管理系统查看公共课期末考核安排。(注意:尤其是同一门课程考试有多个考场的情况,如果不按指定考场参加考试可能会误判成缺考)。2.学院开设的专业课程,根...

根据《关于印发<公司教师申请招收博士研究生审核办法(修订)>等三个文件的通知》(校研字﹝2019﹞8号)要求,学院召开学位评定委员会审议表决通过,同意苏显龙等2名教师2025年招收学术/专业硕士研究生的申请,认定安玥琦等31名教师具备2025年招收学术/专业硕士研究生资格。现将结果公布如下:一、获得2025年招收学术/专业硕士研究生资格的教师(首次)序号导师姓名导师编号类别(学术/专业)代码、名称1苏显龙20220183学术...

公司全体本科生、专任教师:为激发公司本科生科学探索精神、主动进实验室学习热情,进一步提升员工的创新能力,学院特设立“本科生科研培育基金”,旨在通过项目立项的方式,为参与学科课外科学竞赛或发表论文、授权发明专利的员工提供经费支持。现将相关事宜通知如下:一、项目宗旨通过资助员工参与科研活动,鼓励员工在学科竞赛中取得优异成绩,或在学术期刊上发表论文、授权发明专利,从而提升员工的科研能力和学术水平。二...

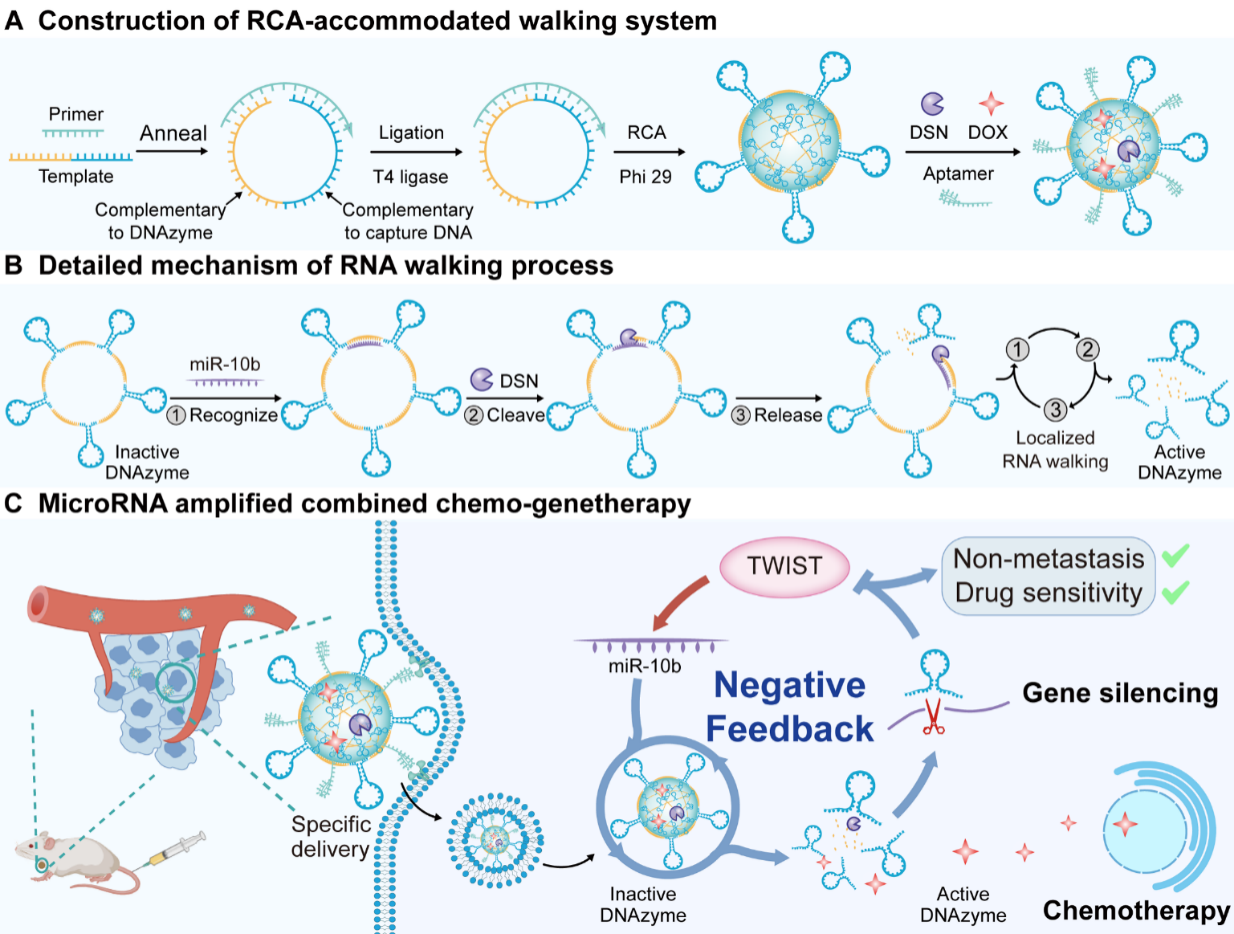

近日, 公海贵宾会员检测中心刘志洪教授团队与武汉大学王富安教授合作,在国际顶尖学术期刊Angewandte Chemie上发表了题为“Self-Adaptive Activation of DNAzyme Nanoassembly for Synergistically Combined Gene Therapy”的研究论文。图1 自适应激活DNAzyme体系的构建与作用机制脱氧核酶DNAzyme在基因沉默方面具备广阔潜力,然而在实际应用中仍然面临挑战。其中,针对病灶部位的特异性治疗与机体安全性难以同时兼顾。...

查看详情

一、基本信息刘志洪,教授,博士生导师,公海贵宾会员检测中心党委常委、副董事长。2011年入选教育部“新世纪优秀人才”,2016年获得国家杰出青年科学基金,2017年入选科技部“创新人才推进计划”,2018年入选“万人计划”科技...

一、基本信息陈勇,教授,博士生导师。1997年入选国家人事部“百千万”人才工程第一、二层次,2000年享受国务院政府特殊津贴。现为药物高通量筛选技术国家地方联合工程研究中心主任、公海贵宾会员检测中心中药生物技术湖北省...

一、基本信息何汉平,教授,博士生导师,硕士生导师,2012年入选“楚天学者计划”楚天学子,主持国家自然科学基金项目3项,省技术创新重点研发项目1项,省自然科学基金1项,其他项目6项。在Adv. Funct. Mater., B...

一、基本信息吴康兵,男,博士,三级教授,博士生导师;入选“教育部新世纪优秀人才”、“湖北省杰青”和“武汉市晨光计划”。主要从事食品安全、环境污染物检测、电化学传感器等方面的研究工作。以通讯作者在...

一、基本信息姓名:陈洪建职称:特任副研究员研究领域:食品营养与安全,农食系统的碳排放与减排电子邮件:chenhongjian@hubu.edu.cn二、教育背景及工作经历2009.09-2012.06 江南大学 本科2012.09-2019.06 江南大...

一、 基本信息许子强,教授,博士生导师,湖北省“楚天学子”研究领域:疾病诊疗 电子邮箱:ziqiang.xu@hubu.edu.cn二、 教育背景及工作经历2022.11—至今 公海贵宾会员检测中心,公海贵宾会员检测中心 教...

一、基本信息李贞,教授,博士生导师,生物医学工程系主任。2016年获武汉大学分析化学专业理学博士学位,2017年入选“中国博士后创新人才支持计划”,2019年入选湖北省“楚天学者计划-楚天学子”,2022年获批湖北...

一、基本信息王凯,教授,博士生导师,副经理,全国石油和化工公司产品名师、中国药学会制药工程专业委员会委员、湖北省院士专家行成员、湖北省首批中小微企业科技副总、鄂州市科技特派员。第45届、46届世界技能...

一、基本信息 叶晓雪,副教授,博士生导师,公海贵宾会员检测中心分子诊断与精准治疗研究中心副主任,入选湖北省青年人才项目,湖北省女科技工作者协会理事。近年来围绕脑部化学测量,开发了一系列基于微电极植入的活体...

一、基本信息李路军,副教授,硕士生导师,执业中药师,湖北省药学会中药与天然药物学会委员研究领域:天然药物化学电子邮件:lilujunhuda@163.com二、教育背景及工作经历2001/09-2004/06: 湖北中医药大学药学...

一、基本信息毛志强,教授,博士生导师,楚天学者研究领域:荧光探针与活体成像、重大疾病的分子诊疗电子邮件:maozq@hubu.edu.cn二、教育背景及工作经历2012.9—2017.6 武汉大学,博士,分析化学2017.7—2018.1...

一、基本信息姜军,副教授,硕士生导师,湖北省“楚天学子”,公海贵宾会员检测中心宜都产业技术研究院副经理,湖北省院士专家行成员,湖北省中小微企业科技副总。研究领域: 药物化学;光催化反应电子邮件:junjiang@hubu.ed...